Regional Market Report – The South West

Introduction

London often takes the spotlight when it comes to discussing the property industry and market trends. But there’s a lot to be learnt from looking outside the capital.

We’ve pulled key data from the major towns and cities in the South West to create a comprehensive report of what’s happening in this area.

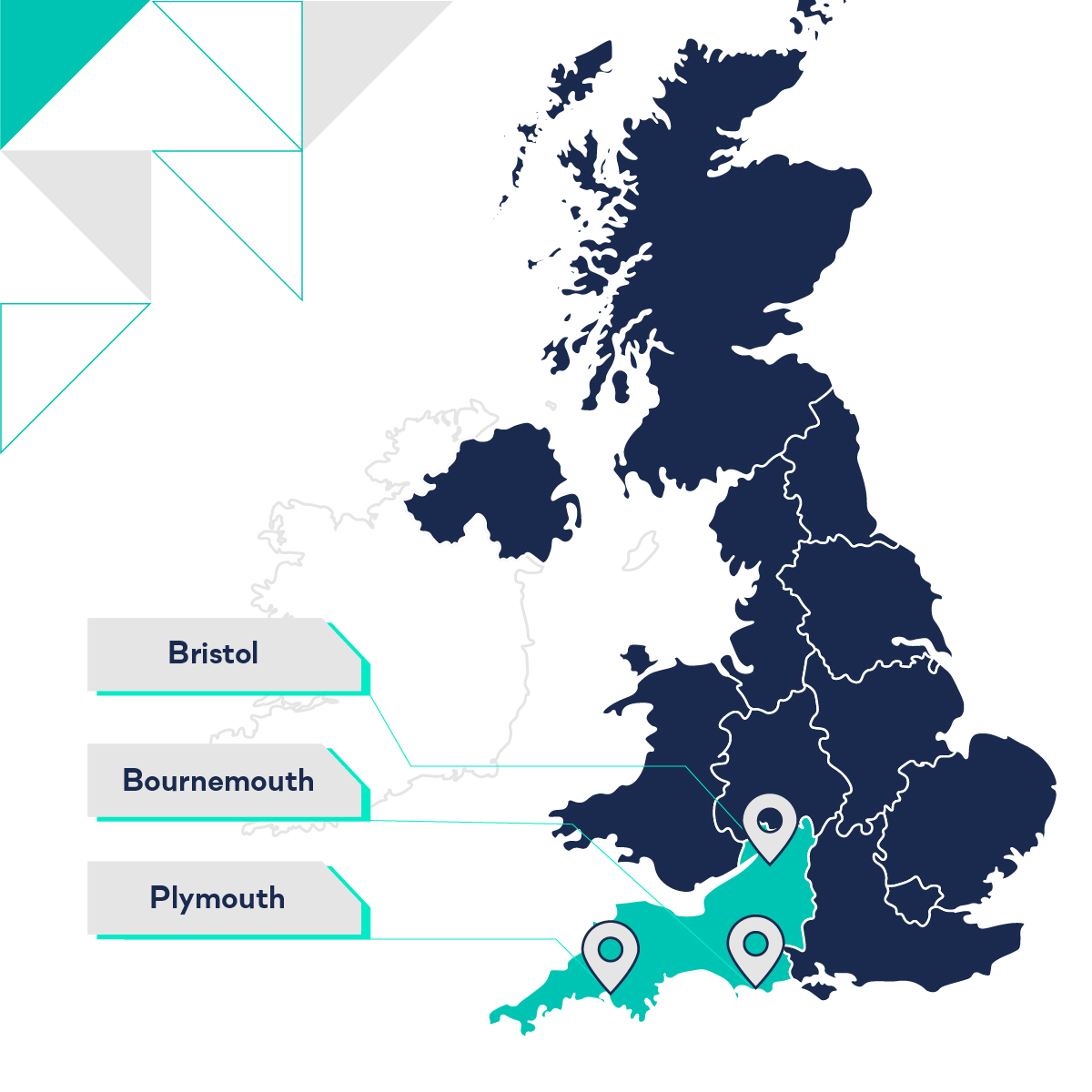

In this report, we’ll be focusing on Bristol, Bournemouth and Plymouth¹ – exploring who lives there, the current state of the housing market, and how the two interact.

So whether you want to look to other regions for inspiration, or want data-driven insights to inform your strategy in the South West, we’ve got you covered.

¹Data is inclusive of the local authority they are situated in, not just the city

The People

Knowing who lives in a specific area can help you understand where the demand lies – and build the type of properties people want, where they want them.

Population density, migration patterns, and the age and income of inhabitants can paint a useful picture of how the housing market is set to develop in the coming years. Understanding all this data can help you pinpoint new opportunities and get ahead of your competition.

Now, none of this is an exact science, but it should give some kind of indication of the direction the marketing is moving – or needs to move in.

Population density

Knowing how many people live in a particular place is one thing, but knowing how densely populated an area is can be a lot more useful when it comes to deciding the type of housing you want to deliver there.

Out of the three cities, Bristol has the largest population and the highest density of people per square kilometer (4,248). Plymouth also has a high number of people per square kilometer at 3,292 and Bournemouth isn’t far behind on 2,449.

As is typical of cities, the lack of space and high-demand for housing influences the type of dwellings that are built there – namely a larger proportion of flats and high-rise buildings.

Migration patterns

Migration in and out of a city adds another layer to that population data. It shows how much the population has increased or decreased due to people moving in and out of the area – particularly useful when trying to anticipate the amount of new housing needed in a town or city. Population increases due to births are less likely to impact demand as the number of properties needed for that family are rarely impacted.

Bournemouth was the only city out of the three to have a positive net internal migration in 2020 and had the highest net international migration – more than both Bristol and Plymouth combined.

The influx of new people into the area highlights the development potential Bournemouth has, but this isn’t to say that Bristol and Plymouth don’t have development potential too. Their needs may just be a little different, such as more new builds for first time buyers who may already live in the area but want to buy their own property.

Age

Source: ONS

Age is a useful indicator of the type of homes people in this area likely want to live in. A lower median age could mean that there will be more renters and first-time buyers, whereas an older median age is likely to mean an increased need for retirement homes or social housing.

Bristol has the youngest population of the three cities, and is the only one whose median age has decreased in the last ten years – from 33.9 in 2010 to 32.4 in 2020.

Plymouth saw the least change between 2010-2020 with only a 0.4 year difference.

In 2020, Bournemouth, Christchurch and Poole saw their median age increase to 42.8 – likely impacted by the number of people moving into this area after retiring.

Income

Of course, the requirements for different types of housing are closely linked to income too.

We’ve used the median income for each of these local authorities as using mean income can mean that particularly high earners skew the data, creating a less accurate picture.

Source: ONS

Looking at median income from 2010-2020, we see some mixed results.

Out of the three local authorities, Plymouth had the lowest median income in 2020 (£26,862) and the smallest percentage increase over the last ten years (13.7%).

In 2020, Bournemouth saw a two-year low for median income (£29,284) but an overall increase of 20.7% from 2010.

Bristol had the highest median income over the last five years, overtaking Bournemouth in 2015, as well as the biggest overall increase during the ten year period (27.5%).

Later on in the report we’ll look at how these figures match up with housing prices in each area.

The Housing Market

Now we’ve established who’s living in key cities in the South West, we can see how this correlates to the housing market. Is housing keeping up with demand? Do prices and income match up? How expensive are new-builds?

Average house prices

Source: gov.uk

All three cities are just below the national average of the 10.7% increase in house prices from December 2020 to December 2021.

Bristol stayed the most stable with a 6.4% increase between December 2020 to December 2021 and topped the group for the highest average house price. Highest to lowest average house price loosely correlates with median income in terms of a like-for-like comparison.

Alternatively, it could be a reflection of the higher median age (coastal towns or cities are often chosen as retirement spots) or prices being driven up by people from out of town buying a second property close to the beach. Coupled with the high level of net migration, it’s more likely that people are moving here from another region (where income is likely higher) to live permanently.

When we zoom out to look at how house prices have changed over the last decade, Bristol has made the biggest leap – 87% from March 2011 to March 2021 – in fact, it’s the only local authority not in London to make it into the top ten.

Many people are attracted to living in Bristol, viewing it as a smaller, more laid-back alternative to London. Add in blossoming creative, tech, and aerospace industries and it’s a draw for high-paid professionals, resulting in the higher wages we saw earlier.

Plymouth saw the biggest average house price increase in the last year (10.6%), despite having the lowest ten year increase in median income. Therefore, it’s likely that these heightened prices are largely spurred on by the increased demand for properties in Devon and Cornwall and not by the growing wealth of local inhabitants. This could signal a need for more affordable housing to combat the gap between these inflated prices and the income of inhabitants.

Housing sales volume

Numbers were a lot lower in October 2021 than they were just a few months before when the stamp duty holiday caused a real boom in sales.

They were also pretty consistent across the board for the three cities: Bristol was at 185, Bournemouth at 163 and Plymouth at 147.

New-build premiums

The new-build premium is a way of comparing the difference in price between new builds and existing properties. We used price-per-square-foot data to estimate the new-build premium so you can spot opportunities in areas where there’s the biggest profit margins to be made.

From the data above, we can see that on the whole new builds in the South West tend to be selling for more.

In 2021, Bristol had the lowest new-build premium out of three local authorities at 7.61%.

Bournemouth’s new-build premium was slightly higher at 16.12%.

The price of new properties in Plymouth were significantly higher than for existing builds in 2021 at 40.65%. After Torbay (47.05%), this is the second highest figure we are seeing for new-build premium in the South West.

The high new-build premiums in cities across the South West (Bristol is one of the few areas with a negative new-build premium) reflects the increasing demand for new housing in this area – either as a second home or for first-time buyers looking to get on the property ladder.

It’s an encouraging sign for developers that the growing interest in the region is already translating into increased profits from new build developments.

Housing delivery targets

Every local authority has their own annual housing delivery targets that they should meet. The percentages shown in the graph are the amount of houses that local authorities have delivered against their targets for the last three years.

Bristol was on a downward trajectory from 2018-2020, but saw a slight uptick to 74% in 2021 – still coming in significantly under target for four years in a row.

Bournemouth, has also been under target for four consecutive years, with 2021 seeing their second lowest score of 67%.

Plymouth on the other hand has been over-delivering on its target for four years in a row, but saw a slight decrease in performance in 2021 achieving 128%.

Apart from Plymouth, housing isn’t being delivered in these cities at the rate it’s needed, presenting developers with potential opportunities in this region. Particularly when considering the high new-build premiums – not only will you be providing housing in areas where it’s needed, but you’ll likely make a good profit whilst doing so.

It’s worth noting that, as cities, there’s likely to be much less space for development – especially when you’re closed in by a large body of water on one side. Lack of space and available land in cities can also make it more difficult to get planning permission. Unless you’ve got brownfield sites close by, you may have to apply for development on greenfield, or even green belt land.

This point is evidenced by the fact that a lot of Bristol, Bournemouth and Plymouth’s neighbouring (and more rural) local authorities are frequently exceeding their targets.

Despite two out of the three cities falling short of their housing delivery targets, in comparison to the South East, the South West as a whole is doing considerably better.

Percentage of protected land

We can often see a correlation between the amount of protected land in a local authority and their performance in the recent Housing Delivery Test.

As we saw above, Bournemouth has been underperforming quite significantly when it comes to housing delivery. The reason for this becomes more clear when we look at the amount of land which is restricted across the local authority. 36.7% of all land is classified as protected, with over a third as part of the Green Belt.

With such a high percentage of land protected, it makes it difficult for developers to find sites with development potential – and increases the competition for sites that are viable. In turn, this drives up the price for the end consumer, as we can see reflected in Bournemouth’s house prices.

On the other side of the scale, we can see that in Plymouth (who have consistently performed over target for the last four years) only 0.4% of land is protected.

Bristol sits middle of the table for both delivery and proportion of protected land. 6.4% of their total land was protected, with 5.5% of that Green Belt. Although this is significantly lower than Bournemouth, their housing delivery performance is pretty similar. Bristol is a more dense urban area so land is likely to be more scarce than the more varied landscape of Bournemouth’s local authority.

Table of contents

Turning obstacles into opportunities

The South West has always been a favoured destination for UK holidays, but with more people working remotely and the rising popularity of cities like Bristol, it could now see more people making the move permanently.

Hurdles such as high population density and limited space to expand can be red flags for developers while other significant constraints, like the green belt and an increased risk of flooding, can be designed around.

There’s also been a few examples recently of planning approval being granted on green belt land where there’s a significant demand for housing, or a high predicted economic return.

Strategic land could be an attractive play here as buying land in prime locations that these cities are likely to expand to next could result in a big payout further down the line.

That means with the right ways to source off-market sites (like, I don’t know, ahem LandInsight?) there are a lot of opportunities still to be found.

We’ll be updating this report whenever we have new data and we’ll let you know when new content is added.